Understanding Risk Premia and Yields: A Comprehensive Guide

Exploring the Different Types, Methods for Measuring, and Examples of How to Interpret Events in Financial Markets and Investing

Introduction

Investing is giving up cash today to get cash in the future. The key questions to think about are:

How much cash do you get back?

How do you get it back?

When do you get it back?

How much do you have to give up today?

This post will be talking about question 4: How much do you have to give up today?

What are risk premia?

Risk premia - the compensation investors require for taking risk

Example: Insurance premiums are risk premia in everyday life.

Home insurance transfers the financial burden of home damage from the owner to an insurance company.

3 notes from the sentence above:

Price: The premium is the price the insurance company requires to bear that financial risk

Uncertainty: The insurance company makes or loses money based on the number and severity of events relative to the premium collected

The more risk/uncertainty, the more the premium

Risk premia in investing are similar; they are the amount of extra return an investor requires to take on additional risk. Said differently, a risk premium is the amount investors charge for additional risk or uncertainty compared to another opportunity.

Similar to insurance, a risk premium is not guaranteed to pay off, but over the long run, they tend to have positive performance (otherwise people wouldn’t do it or the price would decrease until it did).

Why are Risk Premia important?

Risk premia are the fundamental building blocks of asset returns. On one hand, you have the cash flows and on the other hand you have the risk, and therefore price, associated with those cash flows.

Example

Below is an example of how you would decompose the yield of Investment-Grade (IG) debt into underlying risk premia. Each of those risk premia have nuances associated with them. By breaking down the asset into sub-components you can better understand what is driving its yield and see which part is expensive or cheap relative to history.

At each moment of time, an asset’s yield can be broken into building blocks called risk premia. We will walk through how this is done below.

Note: You will hear people use the term risk premia and factors interchangeably. For clarity, I will keep cross-sectional factors like momentum, value, carry etc. separate from risk premia.

Theory

Risk premia are expressed as yield differentials. Yields generically can be defined as:

Yields for bonds are straightforward and usually easy to find. Equities are more complicated because much of their return is from capital appreciation, which is volatile and isn’t a realized cash flow. Earnings are a common alternative because earnings are either paid out in dividends/buyouts or retained for future growth. You see different ways of calculating the yield for equities, but they all usually follow a dividend discount model (DDM) and/or earnings based approach.

Relationship of Yield and Price

Yields move in the opposite direction of price. If the price a cash flow commands increases, the yield decreases. If I am already invested, I make money as a risk premium compresses (higher price per cash flow), but if I am not yet invested, this means I would be paying more for an expected cash flow.

Yields are the inverse of multiples. For instance, earnings yield (EY) is the inverse of Price-to-Earnings (PE) Ratio for equities.

Most bonds have fixed coupon payments, so fluctuations in price drive yields. Equities are more complicated because both their earnings and prices move through time (more about this at the end).

Relationship of Yield and Risk Premia

The easiest way to think about risk premia is blocks stacking on top of each other. As you move into riskier investments, you add another premium on top of a less risky asset. To isolate them, you calculate the difference between asset yields.

This means you have 4 variables that can drive a risk premia, the cash flows of the less-risky/riskier asset and the price of the same two assets. Risk premia are driven by the relative movement of those 4 variables to each another.

It is important to understand yield and risk premia to know how asset prices are moving relative to one another and history.

Summary

Yields are Cash Flow divided by Price

Risk Premia are yield differentials (spread between 2 assets)

Risk Premia (and yields) move inverse of price

i.e., falling risk premia means riskier asset price is increasing more

Let’s walk through how this works.

Calculations and Examples

Cash or Risk Free Rate

Cash (or the “risk free rate”) is the most basic building block of asset returns. “Risk free” is slightly misleading as nothing is truly risk free (even keeping money under your mattress has its risks), but it is the term reserved for short-term US Treasury notes (TBills), which is the least risky investment that most individuals can access. Many times when talking about risk premia people will leave it off because “it isn’t taking risk,” but I like to include it to give the full picture.

Cash is important because everything else is priced off of it. If I can earn 4% lending to the US government, I am not going to lend money to a business for less.

This is why the Federal Reserve raising overnight interest rates matters. When they hike, the cost of all other forms of risk tend to increase as well.

Calculation:

It is common to use the 3 month Treasury yield (shown below) or another preferred cash yield (like LIBOR or now SOFR). I include 0% because the alternative is to not invest, which earns you nothing, and I want to stay consistent with the relative nature of risk premia.

Term premium

Short-term bonds are less risky than long-term bonds because there is less time for a default to occur and have inflation erode the value of a bond’s principal. As such, the longer the term on the bond, the riskier it is, and the Term Premium is the charge for taking that extra risk.

The term premium is calculated using the difference between yields for government bonds at different maturities within the same country.

As with all risk premia, Term is usually positive because longer dated bonds are riskier than shorter dated ones (all else equal). However, this condition does not always hold.

As I am writing this, the 3-month Treasury yield is below the 10-year Treasury yield. This means you can purchase a shorter term bond for a higher yield. This is called an inverted yield curve. A normal yield curve is called upward sloping as the longer maturities have a higher yield.

This is highly unusual, but not unheard of. Without going into too much detail, when this occurs, it means investors think short term rates have gotten too high and will decrease in the future.

You will also notice in the chart below: an inverted yield curve does not last long. Either the short end falls, or the long end increases. This lines up with intuition: why would I invest in a riskier investment when I can earn more for a less risky investment? Negative risk premiums are inherently unstable because investors will either demand more premium or cash flows will adjust to bring the market back into balance.

Calculation:

Notice, the term premium stacks on top of cash. Said differently, a 10 year yield is cash + 10 year term premium.

The 10 year bond is common to use, but people have different preferences. You can technically calculate this off any pair of maturities, which is why it is best practice to specify (10yr -3m below).

Credit Risk Premium

Corporate bonds are riskier than government bonds because companies have a higher likelihood of defaulting on their loans than governments. As such, companies are charged a spread on top on government yields for the same maturity note.

That spread is the Credit Risk Premium.

Corporate bonds are largely grouped into 2 broad categories:

Investment-Grade (IG)

Junk or High Yield (HY) bonds

The technical classification is based on if a bond’s credit rating is above or below BBB (or equivalent). Similar to Term, it is best practice to specify your definition (IG, HY, HY-IG, AAA, etc.). In calculating credit, it is important to match the duration of the bonds.

Calculation 1:

An alternative (and my preferred) is to use CDX spreads. If you recall from the posts Introduction to Derivatives (part 1 and part 2), CDX is the cost to insure against default, so a CDX spread is a pure expression of credit risk. The downside to CDX is its short history (early to mid-2000s).

Calculation 2:

As mentioned above, IG is the example, but this works for HY as well. The chart below shows the IG CDX spread backfilled with IG yields minus duration matched treasury yields.

Equity Risk Premium (ERP)

Investing in equity is riskier than bonds because interest on bonds must be paid before dividends can be paid to shareholders. Additionally, if a company goes bankrupt, bond holders are paid out first (in order of seniority), and equity shareholders are paid out if there is any remaining cash (there is rarely any remaining), which means equity holders lose 100% of their investment in bankruptcy.

All of this means the cash flow to equity holders is more uncertain, and thus riskier than bonds, which means they command a higher premium.

Calculation:

There are many different preferences for calculating ERP. The calculation above (and shown below) is based on the Yardeni method. The NY Fed has a paper reviewing other methods if you want to dive deeper (link).

Other Common Risk Premia

The largest, most common risk premia are shown above, but this topic goes deep. Other risk premia include:

Real Risk Free Rate

Emerging Market Risk Premium (EM vs DM debt)

Country Risk Premium

Inflation Risk Premium

Volatility Risk Premium

Size Risk Premium (Small Cap vs Large Cap Stocks)

(Il)Liquidity Risk Premium (private vs public equity)

Why calculate risk premia?

The main reason for calculating risk premia is to understand where pricing is moving relative to other assets. For instance, corporate bond yields have increased recently, but if you look at the risk premia, Credit has barely increased, Term has moved negative, so the increase in IG bond yields has largely been driven by an increase in Cash. In recessions, Credit tends to spike, but we haven’t seen that happen yet. It is easier to spot this fact looking at risk premia than yields.

On top of understanding where pricing is, research and analysis can be more targeted using risk premia than asset yields. For instance, HY bonds have exposure to Cash, Term, and (HY) Credit premia, and each of those behave differently in economic environments. Credit has a negative relationship with growth (as growth falls, credit spreads increase), while cash has a positive relationship (cash yields fall during most recessions). By decomposing assets, you can target certain exposures more cleanly and better manager you risk.

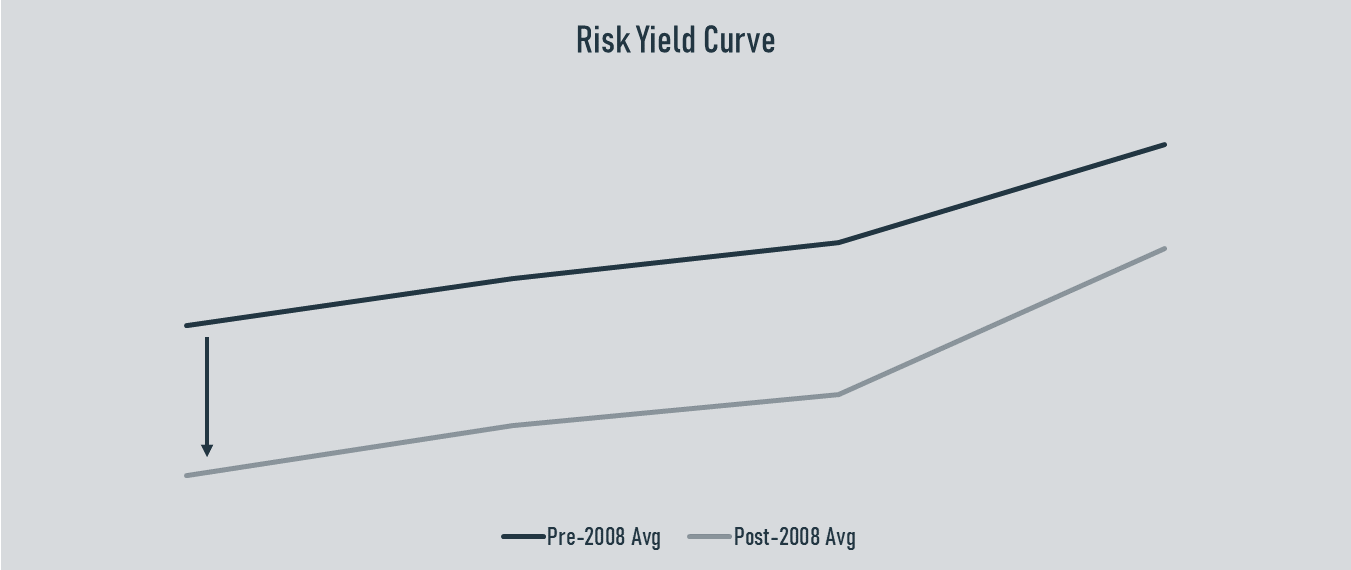

Yields and Risk Premia Since 2008

During the 2008 financial crisis, the Fed dropped the overnight rate to 0% and then began Quantitative Easing (QE) where it printed money and bought government bonds on the open market. This drove interest rates down and pushed money into riskier investments.

More demand for risk assets drove asset prices higher and yields lower. All assets saw this happen, but bonds, having fixed cash flows, saw yields fall more than equities. Earnings were able to partially adjust due to the lower interest rates, which allowed equity yields to stay higher relative to bonds (raising the ERP). You can see in the Equity chart above, ERP was elevated relative to history.

Today

The Fed is now increasing the Federal Funds Rate and shifted to Quantitative Tightening (QT) where they sell bonds in their balance sheet. This increases the supply of bonds and reduces the amount of money in circulation. Money will shift back into cash and bonds as they have higher yields, and it is likely the ERP reverts to a more normal range.

This means the effects of QE post-2008 are unwinding, and asset yields are reverting back to a more historic level and spread. The transition will be painful as rising yields means assets are selling off, but the distortion seen in the market over the last 13 years should be coming to an end.

If QE increased ERP, QT should see its compression. This will likely happen from bond yields reverting up to normal levels. Either way, portfolios will likely rebalance back towards bonds as yields increase.

Conclusion

Understanding Risk Premia is vital to understanding what is going on in the financial markets and with your portfolio. This post walks through what yields and risk premia are, examples of how to calculate them, and examples of how to interpret events through yields and risk premia.

Decomposing yields into relative risk premia allows investors to understand how much incremental return they are picking up from adding additional risk. You can look at risk premia relative to history and other premia to triangulate whether prices today are cheap or expensive. It is one perspective to help you understand our question 4 from above: How much do you have to give up today?

This post is intended to be used for informational purposes only and is not an investment recommendation or advice.