tl;dr

Yes, Bitcoin fulfills the 3 functions of money (Store of Value, Unit of Account, and Medium of Exchange).

Medium of Exchange and Unit of Account are straightforward because people transact in Bitcoin.

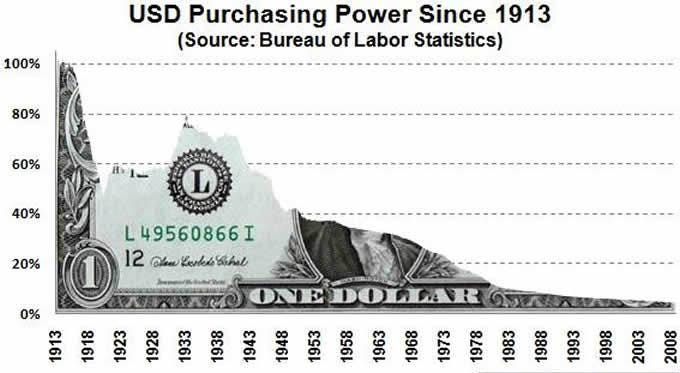

Many people point to the volatility of Bitcoin as evidence that it is not a “store of value.” But, what is a “store of value?” The US Dollar is worth a fraction of what it was in 1913.

As Bitcoin gains adoption, its volatility should decrease, and it's fixed supply makes it ideal for eventually being the best store of value among current options.

Introduction

At the end of the day, money is what people think it is. Shells, stones, coins of various materials, and now fiat currency have all been used as money. What makes Bitcoin any different than these examples?

Below we will walk through a brief history of money, the 3 functions of money, and show how Bitcoin stands up.

3 functions of money:

Medium of exchange

Unit of account

Store of value

Barter Society: Medium of Exchange

How did “money” as a concept come to be?

Way back, we lived in barter societies. You raised corn and needed a hammer. I have a hammer and need food. We barter (make a trade), corn for a hammer. Simple enough.

But, what if I need cotton not corn? We would have to find someone who has cotton and needs corn to do a 3-way trade, or we would have to negotiate another arrangement. Bartering product for product gets complicated quickly and doesn’t scale.

Insert money. As a medium of exchange, money is a method of payment. Simply put, you can buy things with it.

In the scenario above, it is a common method of payment that you and I can agree upon and transact in if the goods/services we want to barter for don’t line up.

How does Bitcoin stand up?

You can operate in large portions of society with only Bitcoin (primarily digitally), and the physical world use of Bitcoin is increasing (a trend I suspect will continue).

People will try to confuse you by saying, “But Bitcoin isn’t widely accepted!”

Well neither are most currencies unless you are in a certain location. Sitting in the USA, if I tried to pay with Japanese Yen, I would be told to turn it into US Dollars first. So how “widely accepted” does it need to be in order to be considered money?

I would argue it already is.

Conclusion: Yes, Bitcoin is a medium of exchange

Hard/Commodity Currency: Unit Of Account

The need for “money” grew out of the impracticalities of bartering, and the first currencies were a form of rare physical substance (gold being the most prominent example). Beyond the ease of transactions money provides, it also provides a common language to talk about the value of something.

How would you describe the value of corn in a barter society? 1/5th of a hammer, what about in cotton? Money provides a common language for a society to discuss relative cost of goods/services. In a grocery store, you can evaluate the cost of two cans of soup by looking at how much each costs.

Entire industries, such as accounting, are possible because money serves as a unit of account. The advent of money allowed for business to develop and trade between people groups to emerge.

How does Bitcoin stand up?

Bitcoin can easily serve as a unit of account. In fact, I would argue it would make a better unit of account than any other currency today because it is not tied to a particular country.

Conclusion: Yes, Bitcoin can serve as a Unit of Account

Paper Currency: Store of Value

The native inhabitants of the Yap islands of Micronesia used large large Rai stones as a type of currency until as recently as the 19th century. Some of these stones could be moved, but many were large enough where they wouldn’t move. But everyone knew who these stones belonged to, and they would transfer ownership.

As my college professor told the story (haven’t been able to verify if this is true or not), there was even a stone lost at sea that no one in living memory had seen. But, everyone still knew who owned it, and it was also used as payments even though no one in living memory had seen it.

As the Yapese people found out, hauling around giant stones was very impractical. Thus, paper currency emerged as hauling around gold coins is very impractical.

At first, paper currency was “gold backed,” meaning you could take your paper currency and exchange it for gold at any time, often called hard or commodity backed. As that “backing” becomes rigid (a topic for a later date), societies have moved away from being directly backed/convertible to being what is called “fiat.”

And the history of fiat currency is it deteriorates or "inflates” away. Since the introduction of the modern US Dollar (USD) in 1913 with the creation of the Federal Reserve (Fed), the US Dollar has been losing value. This became more pronounced in 1971 when Nixon ended the US Dollar’s convertibility to gold (once again, a future topic). Here is the value of the US Dollar up to 2013, so not even including the most recent bout of inflation we are currently experiencing (source).

If you want to learn about the concept of inflation, its causes, effects, and strategies for managing its impact on the economy, read this article.

How does Bitcoin stand up?

I bring up this chart to show that “store of value” is a loose, misunderstood term. Often, academics mean it doesn’t rot or deteriorate like corn or a car. The reason we don’t feel it as directly as the volatility as Bitcoin is due to the fact that things are still quoted in large major currencies (especially US Dollars).

Said differently, when people talk about this price of Bitcoin, the talk about it in terms of Dollars. However, if more people transacted in it, Bitcoin would be what everything else is quoted in. How volatile is a Bitcoin when stated in Bitcoins?

Adoption is the difference. Bitcoin’s volatility in USD will fall as adoption increases. Bitcoin centric ecosystems are already starting to emerge, so it isn’t a stretch to think this will happen.

The history of money is filled with cycles (Ray Dalio posts about this on his LinkedIn, link below):

Hard → Too restrictive → Fiat → Lack of fiscal constraint → Inflation → Hard

It is not a question of if the US Dollar (and all major currencies) blow up; it’s a question of when.

Bitcoin is an attractive alternative with its limited supply, and I would argue as such it is a store of value.

Conclusion: Yes, Bitcoin is a store of value

Concluding Thoughts

You will see other characteristics of money in the St Louis Fed link below. Those are: Durability, Portability, Divisibility, Uniformity, Limited Supply, and Acceptability.

If you go down the list, I would argue Bitcoin fills all of those characteristics equal to or better than the US Dollar except for Acceptability.

Adoption of Bitcoin is the difference, and that doesn’t mean its not money.

References

https://www.stlouisfed.org/education/economic-lowdown-podcast-series/episode-9-functions-of-money

https://en.wikipedia.org/wiki/Rai_stones

https://www.linkedin.com/pulse/money-credit-debt-ray-dalio

Recommended Reading

BowTied Bull for crypto and general good advice:

To learn about DeFi: